- Home > Blog > Small Business Financing > All About Section 179 and Business FInancing | Quickbridge

All About Section 179 and Business FInancing | Quickbridge

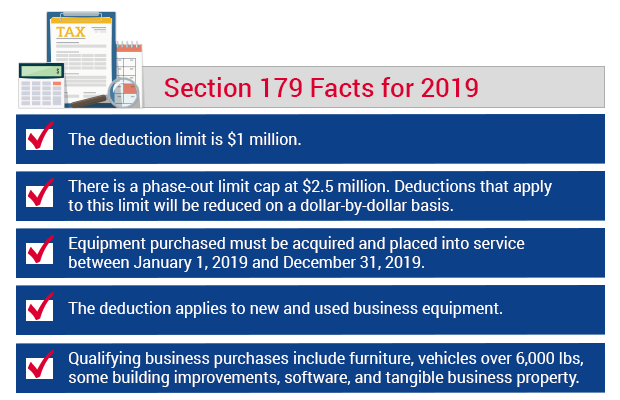

Section 179 and business financing are often linked. The Section 179 tax deduction helps small businesses afford key purchases. Small business loans can provide capital for those assets. Businesses can get a loan, use that funding on a key project, and then file for Section 179 on that year’s tax form. This makes Section 179 and business financing a perfect fit. We take a look at important 2019 updates to Section 179 and how they may affect your small business.

What is Section 179?

Section 179 is a tax deduction that allows small businesses to recover cash up to a portion of what they have spent on qualifying assets. For a long time, the deduction applied almost exclusively to equipment. In recent years, Section 179 has been broadened to apply to a wider range of items.

The Section 179 deduction can be filed for in your annual taxes. Below you’ll find some general guidelines about the deduction, but we highly recommend speaking to your tax advisor prior to making any decisions.

Why is Section 179 Part of Year-End Planning?

The end of the year is a natural time to consider Section 179 and business financing. At this point in the year, you’ll have a strong sense of how much you’ve spent. As such, you don’t have to worry about making a major purchase and then finding you need something else before year-end. As the deduction caps out after a certain amount spent, you want to maximize your returns. For example, if you’re $100,000 short of hitting your deduction cap, you can spend that $100,000 in December and have a clean slate come January. If you made that same $100,000 purchase in September, a comparable investment in December would over-reach your deduction, limiting value.

In the same way, you can make a purchase at the end of the year that you were planning to make in January. This lets you take advantage of deductions in the current tax year. Taking some time to plan your Section 179 and business financing tactics at end-of-year can maximize your opportunity.

Why is Working Capital a Fit for Section 179 and Business Financing?

Equipment financing is a common choice for businesses making a purchase that qualifies for the Section 179 deduction. The specialized loan can cover the costs of expensive equipment. However, that’s all it does. Working capital is a more natural fit for Section 179 and business financing because it covers the full breadth of your new strategies, not just the price of the asset.

Section 179 can be used for a wide range of purchases, making the value of working capital is even more evident. For example, some building improvements are covered by the Section 179 deduction. Equipment financing could cover a specific asset, such as new conference room tech, but that’s it. Working capital can cover the equipment cost, as well as help you buy furniture, cover costs of redecoration, and pay for decorating fees.

As you can see, equipment financing is useful but limited. Working capital can prove a better fit when it comes to Section 179 and business financing.

Do You Have a Purchase in Mind?

If you’re looking to make a Section 179-eligible purchase this year, QuickBridge can help. Our working capital loans can get you quick access to cash to support your plans. Contact us today to learn more or to apply for a loan.

Fast cash for any business need

QuickBridge can help fulfill your business wishlist.